Fintech for an

equitable society

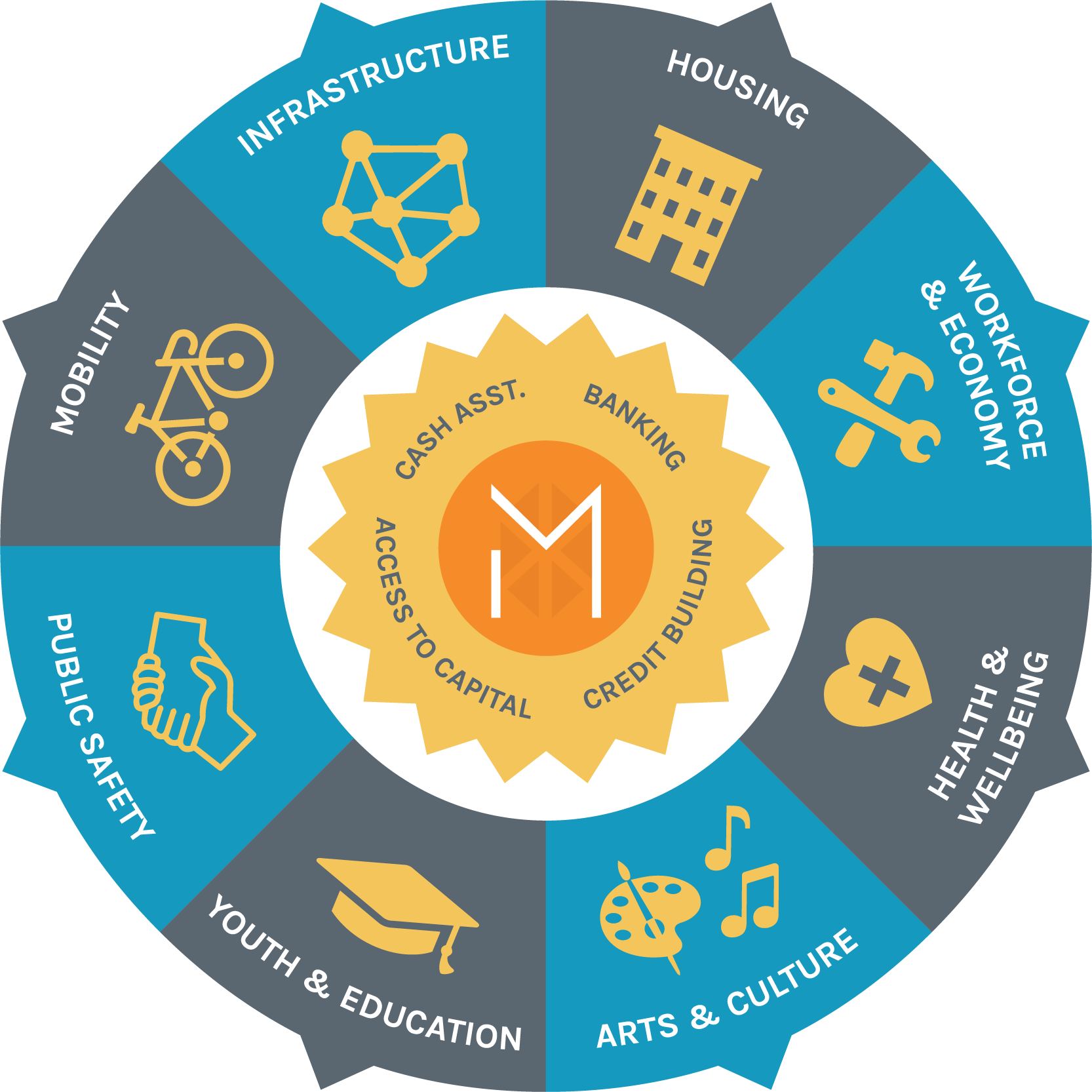

MoCaFi Financial Services as Infrastructure® is a turnkey fintech platform for government and philanthropic organizations to provide individuals and families with cash assistance, mobile banking, and financial programming that creates pathways to wealth.¹

Every year, billions in federal funding for Americans experiencing financial hardship goes unused

Households did not receive cares act payments*

In earned income tax credit left on the table for 5M people annually**

Unfunded for temporary assistance for needy families**

Financial Services

as Infrastructure™

We work with with municipalities, financial institutions, community-based organizations, and private companies to create scalable, sustainable, low-fee infrastructure for financial inclusion at the consumer-level.

Digital Benefit

Payments

Distribute millions in one-time or monthly payments on a prepaid debit card with no-fee ATM access.²

Self-service online

payments portal

We believe in the radical idea that high-quality, low cost financial services can close the opportunity gaps preventing 90 Million Americans from fully pursuing prosperity.

Mobile Banking

Solutions

Off the shelf with physical debit cards, contactless payment capability, a mobile banking app, and 24×7 customer support.

Local Community

Engagement

Build program awareness and onboard individuals to full participation with product launches, lifecycle marketing, financial education and coaching programs at scale.

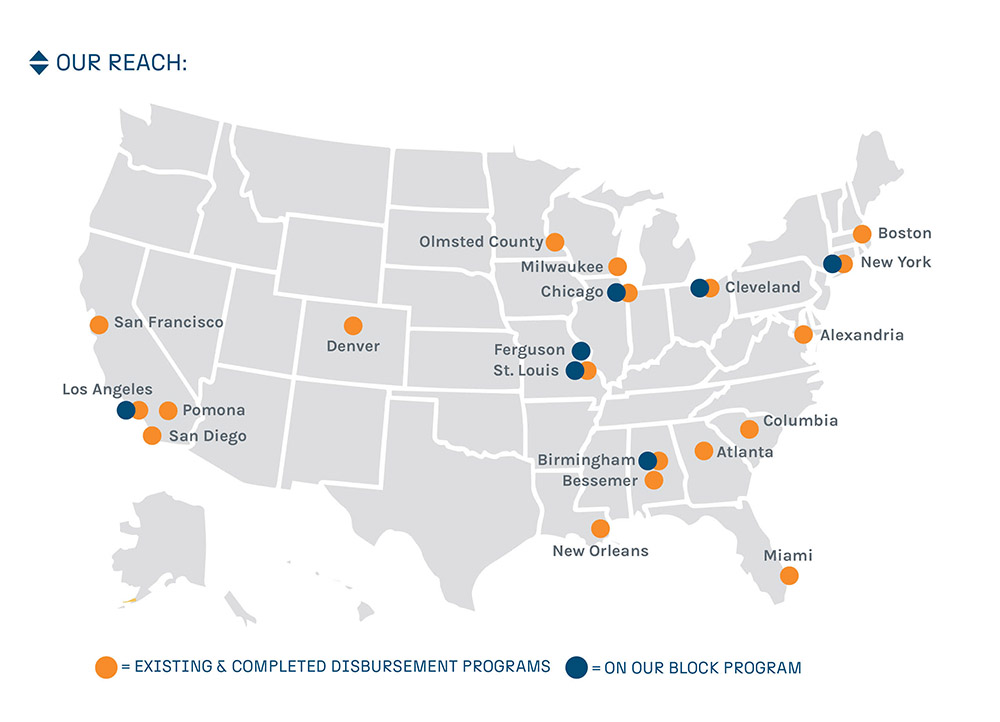

MoCaFi has helped to disburse millions of dollars in government and philanthropic funding in 15+ municipalities.

95,000 +

Platform Users

75,000 +

Immediate Response Cards

20,000 +

Mobile Banking Accounts

4,000 +

Emergency Rental and Utility Assistance Recipients

CASE STUDY:

Emergency Rental Assistance,

Birmingham, AL

MoCaFi partnered with the City of Birmingham to disburse Emergency Rental Assistance Program (ERAP) funding to assist residents unable to pay rent or utilities in the aftermath of the pandemic. MoCaFi’s efficient disbursement supported Birmingham in receiving four rounds of funding. MoCaFi disbursed $14 million dollars to over 3,000 families. Birmingham is the #1 city in Alabama and the city has been recognized as one of the most effective in the country in disbursing rental assistance dollars.

CASE STUDY:

Angeleno Connect,

Los Angeles, CA

MoCaFi has partnered with Los Angeles to launch Angeleno Connect – a digital platform to provide residents with contactless access to cash benefits, city services, and a low-fee mobile banking account. Angeleno Connect supports programs such as LA’s BIG LEAP, the largest city-led Guaranteed Income pilot in the US, emergency rental assistance and homeless services. These programs impacted the lives of 16,000 families.

Image Source: Mayor’s Fund for Los Angeles

“SOCIAL JUSTICE WITHOUT ECONOMIC JUSTICE IS LIKE ONE HAND CLAPPING”

— WOLE COAXUM, FOUNDER & CEO, MOCAFI

Our Mission

To help excluded communities create wealth through better access to public, private, and social capital.

The MoCaFi Bank Account and the MoCaFi Debit Mastercard are issued by Sunrise Banks N.A., Member FDIC, pursuant to a license from Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. The card may be used everywhere Debit Mastercard is accepted. Use of this card constitutes acceptance of the terms and conditions stated in the Account Agreement. The MoCaFi Bank Account is marketed and administered by MoCaFi. MoCaFi is a financial technology company and not a bank. Banking services are provided by Sunrise Banks N.A. Your funds are FDIC insured up to $250,000 in the case of a failure by Sunrise Banks N.A., Member FDIC.

1 MoCaFi credit and wealth building features are not Sunrise Banks N.A. products, nor does Sunrise Banks N.A. endorse these features.

2 Fees may be charged by a 3rd party provider of ATM services outside of the MoCaFi network. Review the MoCaFi Account Agreement for account fee details.

Copyright © 2016, 2024 Mobility Capital Finance, Inc. All rights reserved.